Top 10 Tips for Beginners to Set Up a Personal Budget

In this economy, many of us need to set up a budget and stick to it – sometimes it happens to lack the money for our basic needs, while other times some debts seem to ruin our financial security. Young people who don’t know yet how to design a personal budget need all the help they need in order to make it through the jungle and still have some money for the fun stuff. Let’s see today ten tips for beginners on how to get their way around budgeting for long term benefits.

1. Decide to Start a Budget

If you feel that you spend more than you have and you just can’t make ends meet, the first bold step to take is to start creating a budget and get in control of your own finances. It will take some time to tweak it in your favor, but the process is worth it.

2. Learn How Much You Make

If you are on a fixed montly salary this isn’t so hard to calculate, but if you also have irregular income sources you have to add those to the planning as well. This will help you understand how much you are worth on a given time frame (a month or a year in case you’re a freelancer for instance).

3. Know How Much You Have

Some money are somewhere out there placed in investments, savings, checking accounts, financial instruments or even goods. You need to learn the interest rates and the expenses of all these accounts as they contribute to your net worth and help you predict your future expenses.

4. Mind Your Debts

Student loans, credit cards, car loan, mortgage, money owned to friends or parents – they are all small chunks of debt you can’t ignore but need to include in the budget.

5. Learn How Much You Spend

Make a list of all your recurring monthly expenses – this includes bills, utilities, food, services and so on. This is a hard step for many people, so it would be better for you to keep all the bills for a month and start from there.

6. Determine Your Net Worth

If you subtract the money you owe and the money you spend regularly from the sum that you have (as determined at step 3) you will get your net worth. It may be negative or close to zero, so you will get a real idea on how important budgeting really is.

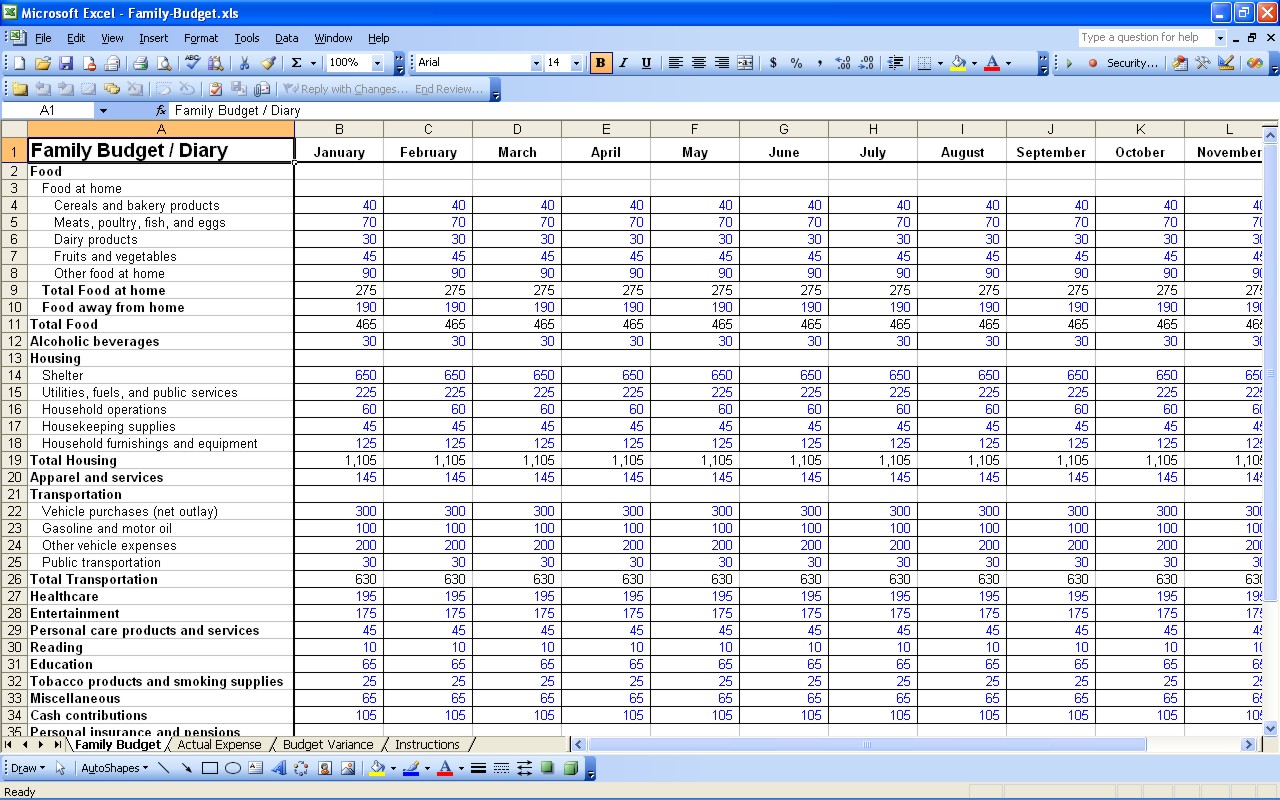

7. Budget Bottom Line

Crunch all these numbers into an Excel document or another budgeting tool and take a look at your bottom line: are you spending more than you make? Is there a comfortable margin that allows you to live comfortably and maybe splurge a little or save some money?

8. Budget Cuts

This is the hardest part: if you are overspending or you live very close to the margins, it’s time to make budget corrections and start cutting some expenses. One of the easiest ways is to work with the monthly expenses numbers and personal expenses. There are plenty of tips on how to save money on the long run and you should get interested in them.

9. Have a Contingency Plan

Your budget is highly dependent on incontrollable factors such as inflation, stock market fluctuations, gas or food prices going higher and so on. No matter how your bottom line is, if you manage to cut some expenses, turn them into savings and a safety net for a long-term contingency plan.

10. Budget Control

Living from one paycheck to the other and having a sustainable financial plan for the medium and long run are two different things. Regularly check on your monthly budget and make adjustments so you are able to gain financial security. Be disciplined with your expenses.

Add Comment